United States Antimony Corporation (OTCBB:UAMY) announced that revenues for the first half of 2007 were $2,717,343, which represents an increase of $593,121 or 27% more than those of 2006. The increase was due primarily to higher margins and increased volumes of antimony products. After many years of deficits, the Corporation built stock- holder equity of $797,072. USAC realized a net loss for the first half of 2007 of $158,875; a decrease of 60% compared to a net loss of $407,269 for the comparable half of 2006. The loss in 2007 was primarily due to expenses associated with the start up and exploration of a Mexican antimony and silver property and Bear River Zeolite (BRZ).

USAC is now the only significant producer of antimony products in the United States. The Antimony Division realized a gross profit of $444,594 for the first half of 2007. The Company has been inundated with orders for more antimony that it can provide. This is the reason that the company is involved with the construction of a mine, mill (Antimonio de Mexico S. A. de C. V.), and smelting plant (USAMSA) in Mexico. The deposit contains antimony mineralization as well as silver and gold mineralization.

The Bear River Zeolite Co., Inc. (a wholly owned subsidiary of USAC) posted a loss of $339,449 for the first half of 2007 compared to a loss of $235,600 for the same period in 2006. The loss was a result of a 2-month shut down and the installation of a new mill. The new mill has been brought on stream during the 3rd Quarter of this year, and numerous bulk and packaged sales are already being made from it. The mill produces finely ground powders used for animal nutrition, a replacement for Portland cement, and many other applications. It is very cost effective on a per ton basis.

Forward Looking Statements:

This Press Release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 that are based upon current expectations or beliefs, as well as a number of assumptions about future events, including matters related to the Company's operations, pending contracts and future revenues. Although the Company believes that the expectations reflected in the forward-looking statements and the assumptions upon which they are based are reasonable, it can give no assurance that such expectations and assumptions will prove to have been correct. The reader is cautioned not to put undue reliance on these forward-looking statements, as these statements are subject to numerous factors and uncertainties. In addition, other factors that could cause actual results to differ materially are discussed in the Company's most recent filings, including Form 10-KSB with the Securities and Exchange Commission.

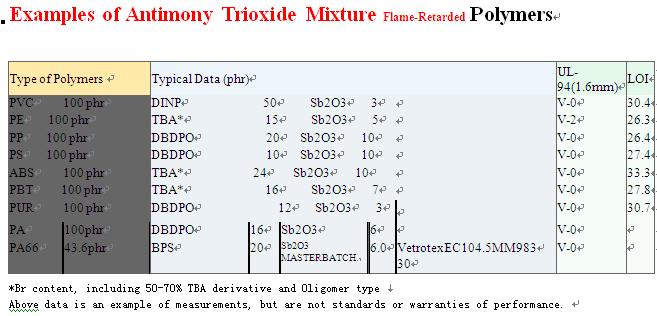

We can supply any quantity and any kind of Antimony products and fire retardant from stock.would you please inform us how many you need and your target price, then we will confirm ASAP. We are sincerely hope to do business with you and establish long term business relationship with your respectable company.

Look forward to hearing from you soon.

Best regards,

Sam Xu

MSN: xubiao_1996@hotmail.com

GMAIL: samjiefu@gmail.com

SKPYE:jiefu1996

Fire retardant masterbatch

0 comment:

Post a Comment