Friday, July 17, 2009

Nonferrous metals price forecasts revised

LONDON: Several market analysts are now forced to eat their words nonferrous metals and revising their forecasts for 2009.

Several nonferrous metals analysts have already revised their predictions for spot nonferrous prices on the London Metals Exchange (LME).

Almost all of the revised forecasts are lower than 2008 averages and show slippage off actual midyear averages, which reflect a projected end of Chinese stockpiling and expectations of an anemic, if any, metalworking recovery late in the year.

According to purchasing.com website, Standard Chartered analysts now expect slight upward momentum in the world zinc price in 2010 as long as demand improves.

Besides that, Reuters News, Bloomberg News and Purchasing.com have tracked down these revisions and forecast price changes of base metals traded on the LME.

They include: Barclays Capital has raised its 2009 price forecasts for copper, lead, zinc, nickel and tin, and said signs of recovery in OECD demand looks set to underpin prices.

The emergence of some physical consumer buying in OECD markets is evidence that destocking has run it course. Although the short term outlook for copper market fundamentals is not very impressive, it expects downside pricing to be limited.

Barclays Capital raised its 2009 price forecast for copper to $1.96 from $1.83 projected earlier. LME copper prices at midyear were $2.27. Barclays Capital raised its 2009 lead metal price forecast to 67¢ from 63¢ and its zinc 2009 forecast to 64¢ from 61¢. The midyear average for LME lead was 75¢ with zinc at 70¢. On nickel prices, Barclays Capital raised its forecast for 2009 to $5.39/lb from $5.05 forecast earlier. It also lifted its 2009 forecast for tin to $5.71 from $5.53. At midyear, nickel averaged $6.70 with tin at $6.80.

Natixis forecasts copper prices to average $1.86/lb and aluminum prices to 61¢. The Natixis outlook sees the average price for lead at 63.5¢, nickel at $5.10, tin at $5.22 and zinc at 61¢. Numis Securities has changed its copper-price forecast for 2009 from $1.40/lb to $1.70.

Bank of America/Merrill Lynch Research analysts still expect copper prices to average $1.77, up from $1.54 projected earlier, while aluminum is forecast 20% higher at 68¢.However, "going forward, if government policies are successful in reigniting growth, physical commodity supply constraints could resurface, resulting in even more commodity price inflation," they write to clients.

Several nonferrous metals analysts have already revised their predictions for spot nonferrous prices on the London Metals Exchange (LME).

Almost all of the revised forecasts are lower than 2008 averages and show slippage off actual midyear averages, which reflect a projected end of Chinese stockpiling and expectations of an anemic, if any, metalworking recovery late in the year.

According to purchasing.com website, Standard Chartered analysts now expect slight upward momentum in the world zinc price in 2010 as long as demand improves.

Besides that, Reuters News, Bloomberg News and Purchasing.com have tracked down these revisions and forecast price changes of base metals traded on the LME.

They include: Barclays Capital has raised its 2009 price forecasts for copper, lead, zinc, nickel and tin, and said signs of recovery in OECD demand looks set to underpin prices.

The emergence of some physical consumer buying in OECD markets is evidence that destocking has run it course. Although the short term outlook for copper market fundamentals is not very impressive, it expects downside pricing to be limited.

Barclays Capital raised its 2009 price forecast for copper to $1.96 from $1.83 projected earlier. LME copper prices at midyear were $2.27. Barclays Capital raised its 2009 lead metal price forecast to 67¢ from 63¢ and its zinc 2009 forecast to 64¢ from 61¢. The midyear average for LME lead was 75¢ with zinc at 70¢. On nickel prices, Barclays Capital raised its forecast for 2009 to $5.39/lb from $5.05 forecast earlier. It also lifted its 2009 forecast for tin to $5.71 from $5.53. At midyear, nickel averaged $6.70 with tin at $6.80.

Natixis forecasts copper prices to average $1.86/lb and aluminum prices to 61¢. The Natixis outlook sees the average price for lead at 63.5¢, nickel at $5.10, tin at $5.22 and zinc at 61¢. Numis Securities has changed its copper-price forecast for 2009 from $1.40/lb to $1.70.

Bank of America/Merrill Lynch Research analysts still expect copper prices to average $1.77, up from $1.54 projected earlier, while aluminum is forecast 20% higher at 68¢.However, "going forward, if government policies are successful in reigniting growth, physical commodity supply constraints could resurface, resulting in even more commodity price inflation," they write to clients.

Subscribe to:

Post Comments (Atom)

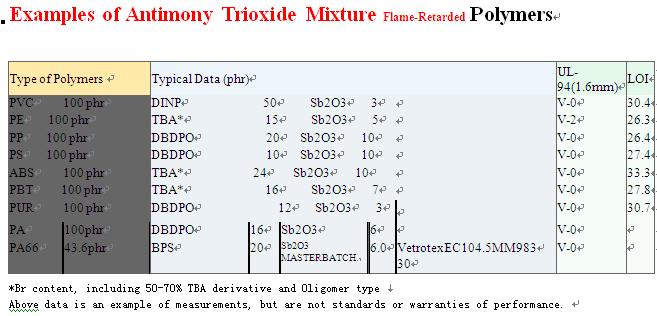

Examples of Antimony Trioxide Mixture Flame-Retarded Polymers

0 comment:

Post a Comment